General Liability Insurance Coverage For Contractors

Completed operations

An additional insured has less protection than the policyholder, but still gains crucial coverage, such as:Defense coverage.

General Liability Insurance Coverage For Contractors - Occurrence-based policy

- Flood insurance

- Home-based business insurance

- Product liability

- Insurer

- Commercial property insurance

- Occurrence-based policy

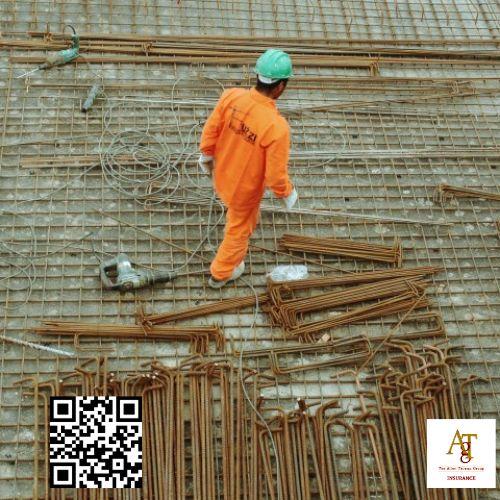

With so much fluctuation, damages easily occur to both the ongoing work and surrounding properties.

General contractors have unique risks.

These policies often combine coverages such as commercial auto, workers compensation and business owners policies into one package.

The Allen Thomas Group Contractor Insurance .